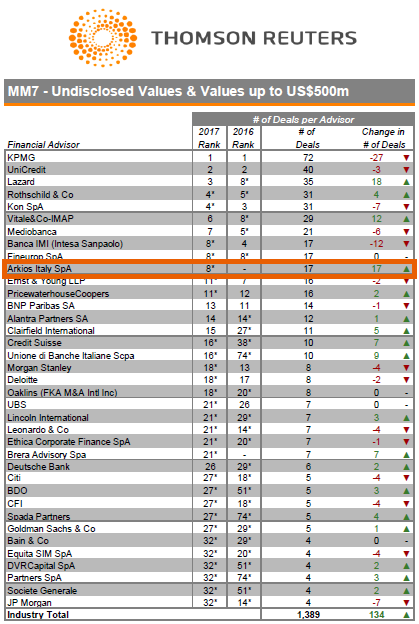

Arkios Italy SpA once again confirms its leadership in Mid-Market M&A, with 17 deals in 2017, according to Thomson Reuters.

Arkios Italy SpA ranks 1° Independent M&A Advisor and 8°overall, before Investment Banks as BNP Paribas, Credit Suisse, UBS, Morgan Stanley, Deutsche Bank, Goldman Sachs, J.P. Morgan, Equita Group – Italy, etc. and before famous Italian Independent Boutique such as: Ethica Corporate Finance, Clairfield International (K Finance ), DVR Capital and International M&A Players such as Alantra, Lincoln International, etc.

Among accomplished deals: BIOLCHIM S.p.A.–ILSA S.p.A., Pro Mach Inc.-P.E. LABELLERS SPA, SQS Group AG.-Double Consulting srl, Quadrivio Private Equity-TFM Automotive & Industy SpA, Europe Capital Partners VI-Industria Alimentare Ferraro, etc.

Thanks to: Paolo Cirani, Paolo Pescetto, Alberto Della Ricca, Andrea Orsi, Gabriele Rollo, Massimo Giacomino, René Lundmark, Giulio Laudani, Hong Hong, Andrea Demichelis, Stefano Buffoni, Andrea Grassi, Paolo Castelli