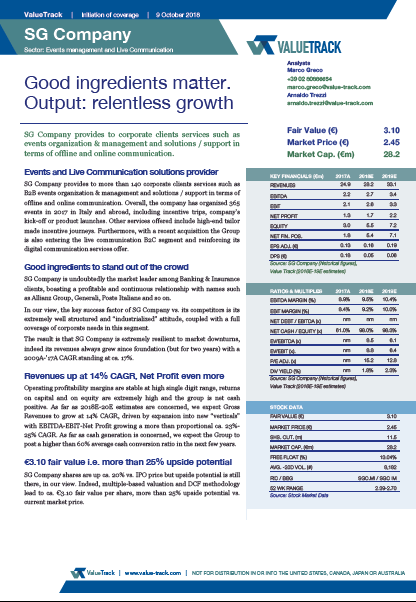

Value Track coverage on SG Company S.p.A. (listed on AIM Italia, current mkt cap at ca. €30mn), a leading events and live communication solution provider. A few takeaways from the research note by Value Track follow below. Arkios Italy SpA acted as Financial Advisor of the IPO

“According to VALUE TRACK Srl, the key success factor of SG Company vs. its competitors is its extremely well structured and “industrialized” attitude, coupled with a full coverage of corporate needs in this segment. The result is that SG Company is extremely resilient to market downturns, indeed its revenues always grew since foundation (but for two years) with a 2009A-’17A CAGR standing at ca. 17%. In 2018E-20E, SG Company is expected to increase its Revenues at 14% CAGR and to maintain its EBIT margin stable at ca. 10%. The Company generates cash and is cash positive. According to VALUE TRACK Srl, at current market price the stock is trading at 9.0x EV/EBIT’18E and – 15.5x PE’18E respectively. We believe that the strong equity story (relentless growth) would deserve higher multiples. Indeed, our valuation analysis leads to €3.10 fair value per share, which implies more than 20% potential upside.” Full coverage at: https://lnkd.in/eQwy_nX